What is a California Bill of Sale?

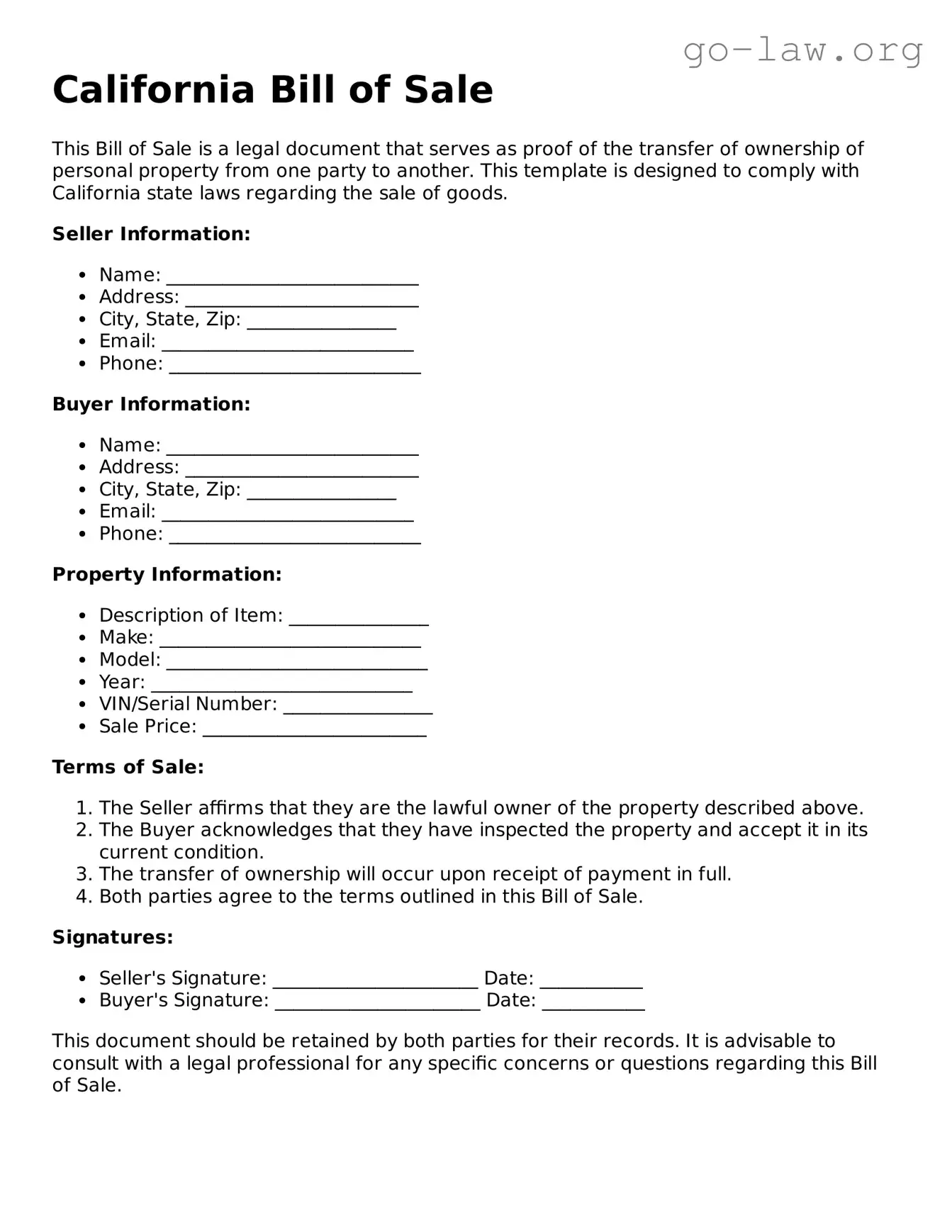

A California Bill of Sale is a legal document that serves as a record of the transfer of ownership of personal property from one person to another. It is commonly used for the sale of vehicles, boats, and other significant items. This document provides proof that a transaction took place and outlines the details of the sale.

Is a Bill of Sale required in California?

While a Bill of Sale is not legally required for every transaction in California, it is highly recommended for significant purchases. For vehicles, a Bill of Sale is often necessary for registration purposes. It helps both the buyer and seller protect their interests and provides a clear record of the transaction.

A comprehensive Bill of Sale should include the following information:

-

The names and addresses of both the buyer and seller

-

A description of the item being sold, including any serial numbers or identifying features

-

The purchase price

-

The date of the transaction

-

Any warranties or guarantees provided

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. It is important to ensure that it includes all necessary information and is signed by both parties. Templates are available online, or you can draft your own document using the required elements outlined above.

Do I need to have the Bill of Sale notarized?

In California, notarization is not typically required for a Bill of Sale. However, having the document notarized can provide an additional layer of protection and authenticity, especially for high-value transactions.

What if the item being sold is a vehicle?

If the item being sold is a vehicle, the Bill of Sale must include specific details such as the Vehicle Identification Number (VIN), make, model, and year. Additionally, the seller must provide the buyer with the vehicle's title, which must be signed over to the buyer at the time of sale.

How does a Bill of Sale affect taxes?

In California, the sale of certain items may be subject to sales tax. The buyer is typically responsible for paying this tax when registering the item with the appropriate state agency. The Bill of Sale can serve as proof of the purchase price for tax purposes.

What happens if there is a dispute after the sale?

If a dispute arises after the sale, the Bill of Sale can serve as evidence of the terms agreed upon by both parties. It is important to keep a copy of the document for your records. In case of a disagreement, both parties may refer to the Bill of Sale to resolve the issue.

Can a Bill of Sale be used for gifts?

Yes, a Bill of Sale can also be used to document a gift. In this case, it should clearly state that the item is being given as a gift and may include details about the relationship between the giver and the recipient.

California Bill of Sale forms can be found online through various legal websites, state government resources, and legal stationery stores. It is advisable to use a form that is specifically designed for California to ensure compliance with state laws.