What is a Texas Durable Power of Attorney?

A Texas Durable Power of Attorney is a legal document that allows you to appoint someone you trust to make financial and legal decisions on your behalf. This document remains effective even if you become incapacitated, ensuring that your affairs can be managed without interruption.

Who can be appointed as an agent?

You can choose any competent adult as your agent, including a family member, friend, or professional such as an attorney. It is important to select someone who is responsible and trustworthy, as they will have significant authority over your financial matters.

What powers can be granted to the agent?

The powers granted can vary based on your preferences. Common powers include:

-

Managing bank accounts

-

Paying bills

-

Buying or selling property

-

Managing investments

-

Filing taxes

You can specify which powers you want to include or exclude in the document.

How do I create a Durable Power of Attorney in Texas?

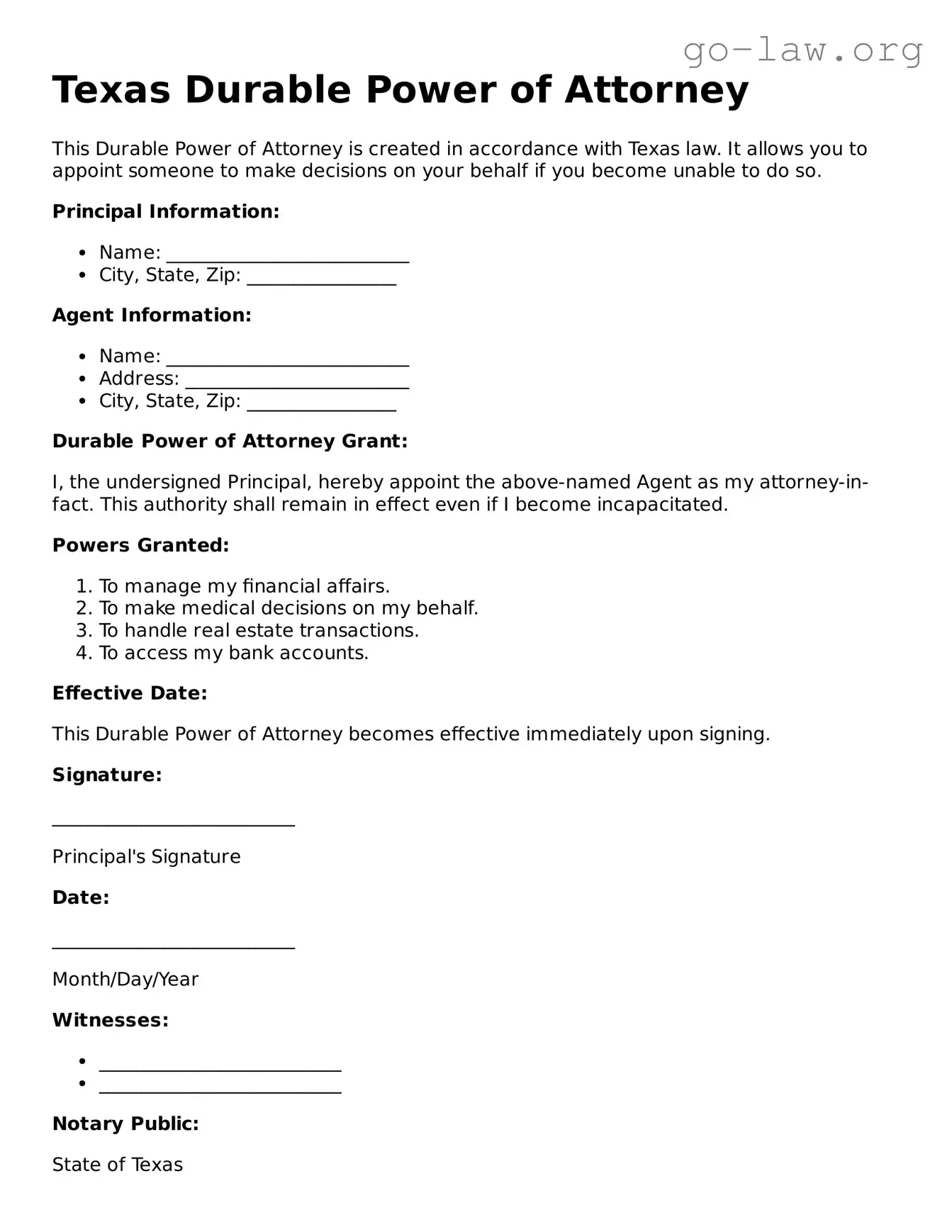

To create a Durable Power of Attorney in Texas, you must:

-

Obtain a Texas Durable Power of Attorney form.

-

Fill out the form, ensuring that you clearly indicate the powers you wish to grant.

-

Sign the document in front of a notary public.

Once completed, it is advisable to provide copies to your agent and any institutions that may need to recognize the document.

Does a Durable Power of Attorney need to be notarized?

Yes, in Texas, the Durable Power of Attorney must be signed in the presence of a notary public to be legally valid. This requirement helps ensure that the document is authentic and that you were not coerced into signing.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are competent. To revoke it, you should create a written revocation document and notify your agent and any relevant institutions that may have a copy of the original document.

What happens if I become incapacitated?

If you become incapacitated, the Durable Power of Attorney remains effective. Your appointed agent can then make decisions on your behalf, ensuring that your financial and legal matters are handled according to your wishes.

Is there a difference between a Durable Power of Attorney and a regular Power of Attorney?

Yes, the key difference lies in the durability. A regular Power of Attorney becomes invalid if you become incapacitated, while a Durable Power of Attorney continues to be effective under such circumstances. This distinction is crucial for long-term planning.

Can I include medical decisions in a Durable Power of Attorney?

No, a Durable Power of Attorney typically covers financial and legal matters. If you want someone to make medical decisions on your behalf, you should consider creating a separate document known as a Medical Power of Attorney.

What should I do with the completed Durable Power of Attorney?

Once you have completed and notarized the Durable Power of Attorney, store it in a safe place. Provide copies to your agent, family members, and any financial institutions that may need to reference it. Keeping everyone informed helps ensure that your wishes are honored.