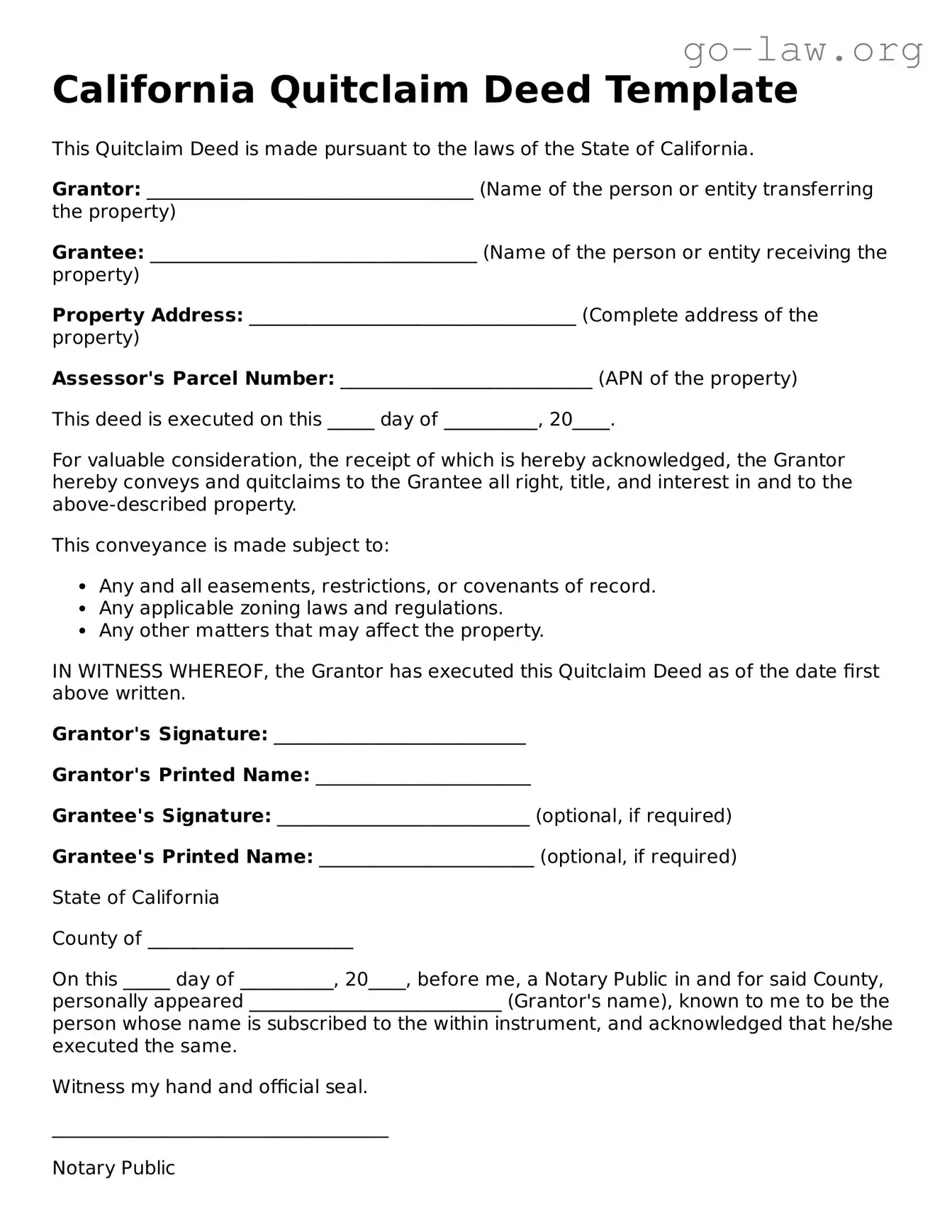

California Quitclaim Deed Template

This Quitclaim Deed is made pursuant to the laws of the State of California.

Grantor: ___________________________________ (Name of the person or entity transferring the property)

Grantee: ___________________________________ (Name of the person or entity receiving the property)

Property Address: ___________________________________ (Complete address of the property)

Assessor's Parcel Number: ___________________________ (APN of the property)

This deed is executed on this _____ day of __________, 20____.

For valuable consideration, the receipt of which is hereby acknowledged, the Grantor hereby conveys and quitclaims to the Grantee all right, title, and interest in and to the above-described property.

This conveyance is made subject to:

- Any and all easements, restrictions, or covenants of record.

- Any applicable zoning laws and regulations.

- Any other matters that may affect the property.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the date first above written.

Grantor's Signature: ___________________________

Grantor's Printed Name: _______________________

Grantee's Signature: ___________________________ (optional, if required)

Grantee's Printed Name: _______________________ (optional, if required)

State of California

County of ______________________

On this _____ day of __________, 20____, before me, a Notary Public in and for said County, personally appeared ___________________________ (Grantor's name), known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same.

Witness my hand and official seal.

____________________________________

Notary Public

My Commission Expires: ______________