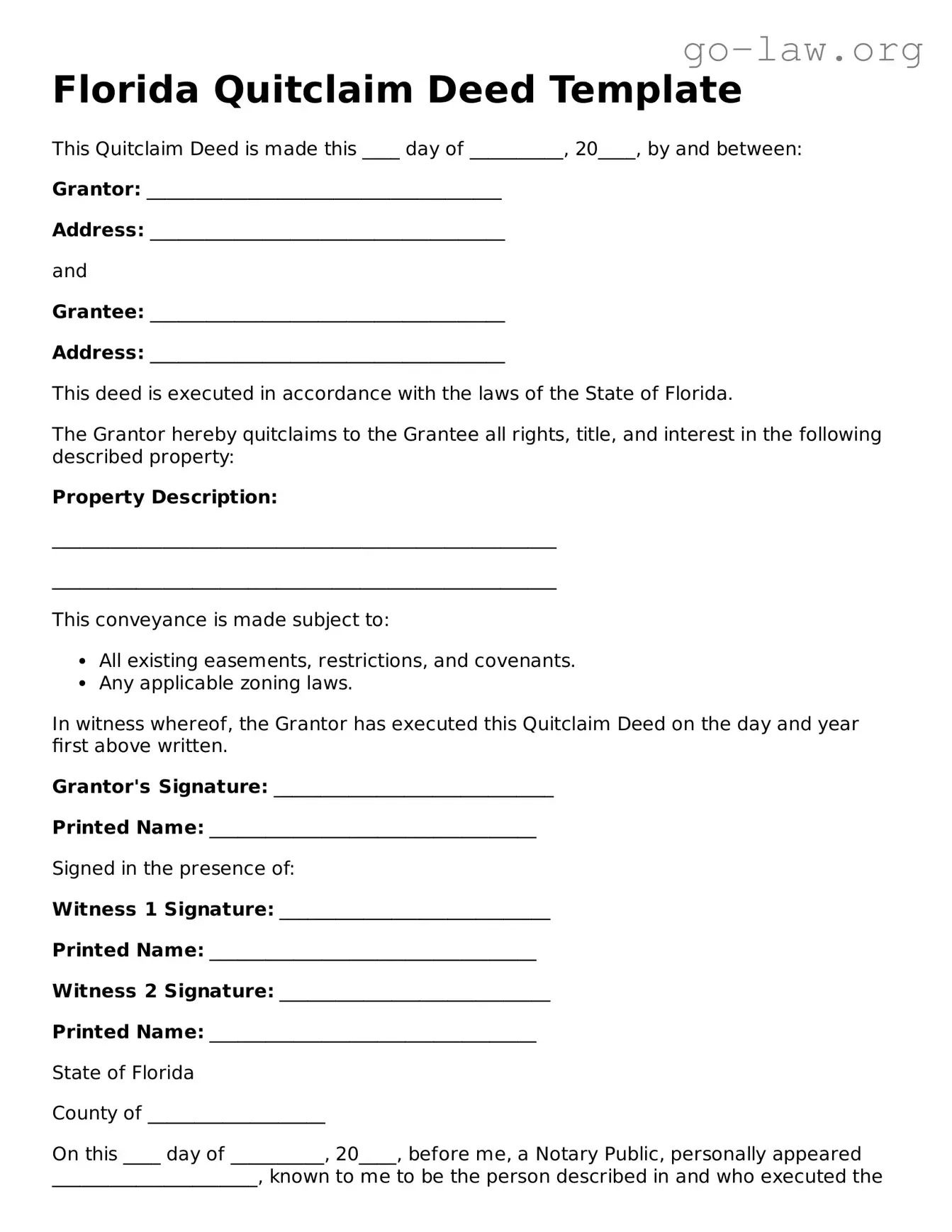

Florida Quitclaim Deed Template

This Quitclaim Deed is made this ____ day of __________, 20____, by and between:

Grantor: ______________________________________

Address: ______________________________________

and

Grantee: ______________________________________

Address: ______________________________________

This deed is executed in accordance with the laws of the State of Florida.

The Grantor hereby quitclaims to the Grantee all rights, title, and interest in the following described property:

Property Description:

______________________________________________________

______________________________________________________

This conveyance is made subject to:

- All existing easements, restrictions, and covenants.

- Any applicable zoning laws.

In witness whereof, the Grantor has executed this Quitclaim Deed on the day and year first above written.

Grantor's Signature: ______________________________

Printed Name: ___________________________________

Signed in the presence of:

Witness 1 Signature: _____________________________

Printed Name: ___________________________________

Witness 2 Signature: _____________________________

Printed Name: ___________________________________

State of Florida

County of ___________________

On this ____ day of __________, 20____, before me, a Notary Public, personally appeared ______________________, known to me to be the person described in and who executed the foregoing instrument.

Notary Public Signature: ___________________________

Printed Name: ___________________________________

My Commission Expires: ___________________________