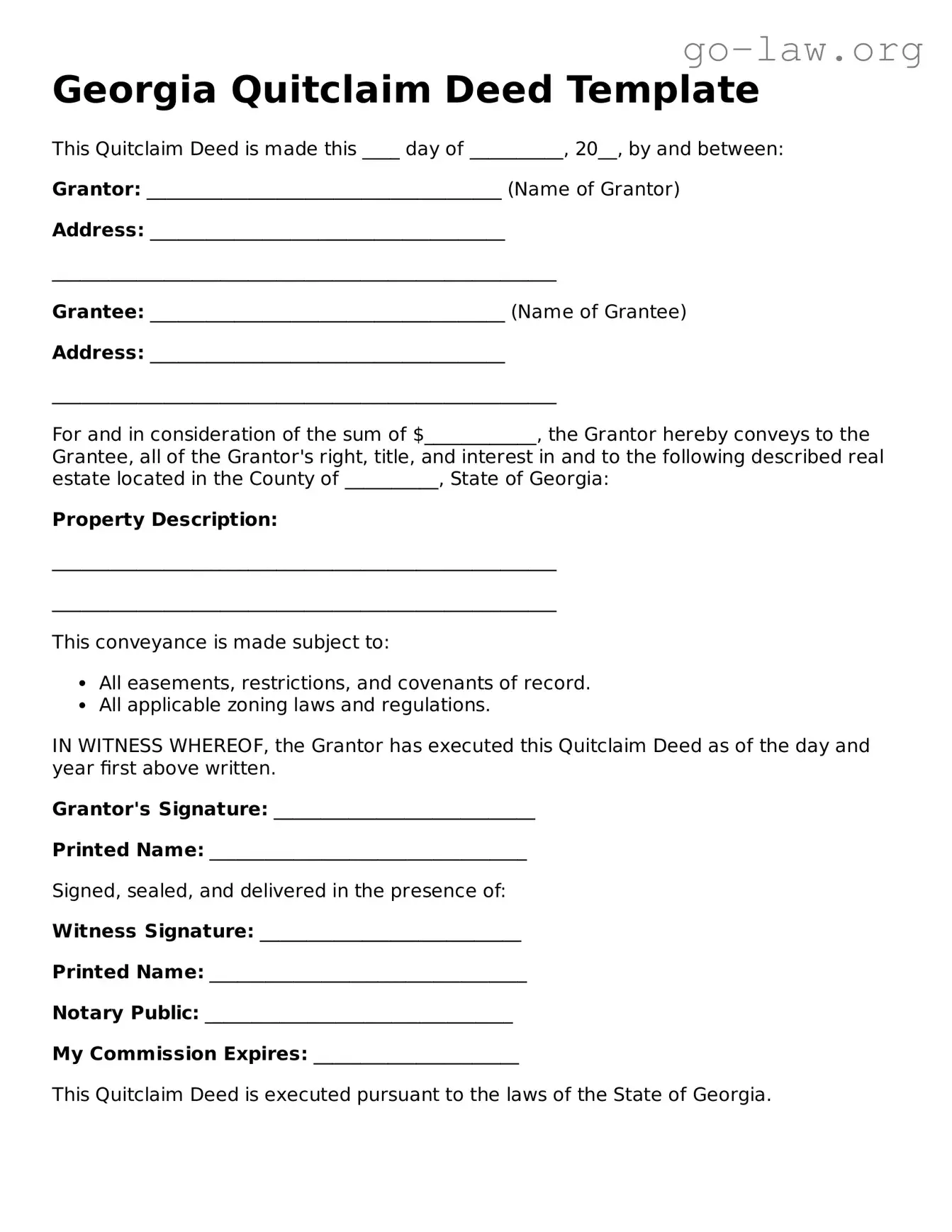

Georgia Quitclaim Deed Template

This Quitclaim Deed is made this ____ day of __________, 20__, by and between:

Grantor: ______________________________________ (Name of Grantor)

Address: ______________________________________

______________________________________________________

Grantee: ______________________________________ (Name of Grantee)

Address: ______________________________________

______________________________________________________

For and in consideration of the sum of $____________, the Grantor hereby conveys to the Grantee, all of the Grantor's right, title, and interest in and to the following described real estate located in the County of __________, State of Georgia:

Property Description:

______________________________________________________

______________________________________________________

This conveyance is made subject to:

- All easements, restrictions, and covenants of record.

- All applicable zoning laws and regulations.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

Grantor's Signature: ____________________________

Printed Name: __________________________________

Signed, sealed, and delivered in the presence of:

Witness Signature: ____________________________

Printed Name: __________________________________

Notary Public: _________________________________

My Commission Expires: ______________________

This Quitclaim Deed is executed pursuant to the laws of the State of Georgia.