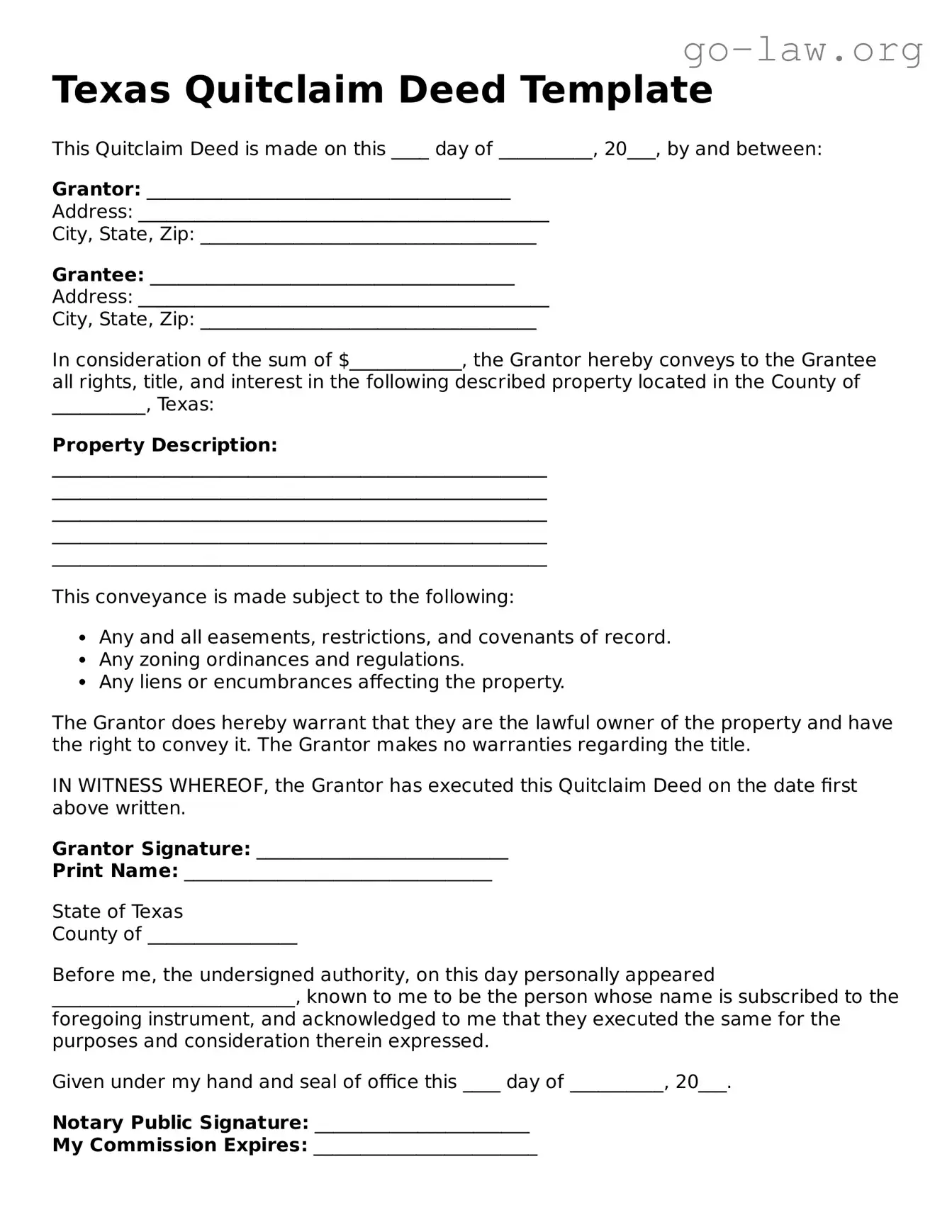

Texas Quitclaim Deed Template

This Quitclaim Deed is made on this ____ day of __________, 20___, by and between:

Grantor: _______________________________________

Address: ____________________________________________

City, State, Zip: ____________________________________

Grantee: _______________________________________

Address: ____________________________________________

City, State, Zip: ____________________________________

In consideration of the sum of $____________, the Grantor hereby conveys to the Grantee all rights, title, and interest in the following described property located in the County of __________, Texas:

Property Description:

_____________________________________________________

_____________________________________________________

_____________________________________________________

_____________________________________________________

_____________________________________________________

This conveyance is made subject to the following:

- Any and all easements, restrictions, and covenants of record.

- Any zoning ordinances and regulations.

- Any liens or encumbrances affecting the property.

The Grantor does hereby warrant that they are the lawful owner of the property and have the right to convey it. The Grantor makes no warranties regarding the title.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the date first above written.

Grantor Signature: ___________________________

Print Name: _________________________________

State of Texas

County of ________________

Before me, the undersigned authority, on this day personally appeared __________________________, known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this ____ day of __________, 20___.

Notary Public Signature: _______________________

My Commission Expires: ________________________